Business Insurance Guide 2026 – Protect Your Business with the Right Coverage

Summary : Business Insurance in 2026 means facing growing risks — lawsuits, cyber threats, property damage, and employee injuries. Whether you’re a freelancer, contractor, retailer, or tech startup, business insurance is no longer optional — it’s essential for survival and growth.

This complete guide explains everything you need to know about small business insurance, including general liability insurance, costs, coverage types, FAQs, and how to get fast quotes.

Table of Contents

Get a Quote for Business Insurance (Fast & Free)

Getting insured is easier than ever. Most providers now offer:

- 100% online business insurance quotes

- Same-day policy activation

- Instant certificate of insurance (COI)

- Flexible monthly payment plans

👉 Start your free quote here:

Internal link: https://technolgy.online/luxury-airline-cabins-2026/

What Is Business Insurance?

Business insurance is a group of policies designed to protect companies from financial losses caused by:

- Lawsuits

- Accidents

- Property damage

- Cyberattacks

- Employee injuries

Example

A customer slips in your store and sues you for medical costs. Your general liability insurance covers legal fees and settlement costs, saving your business from bankruptcy.

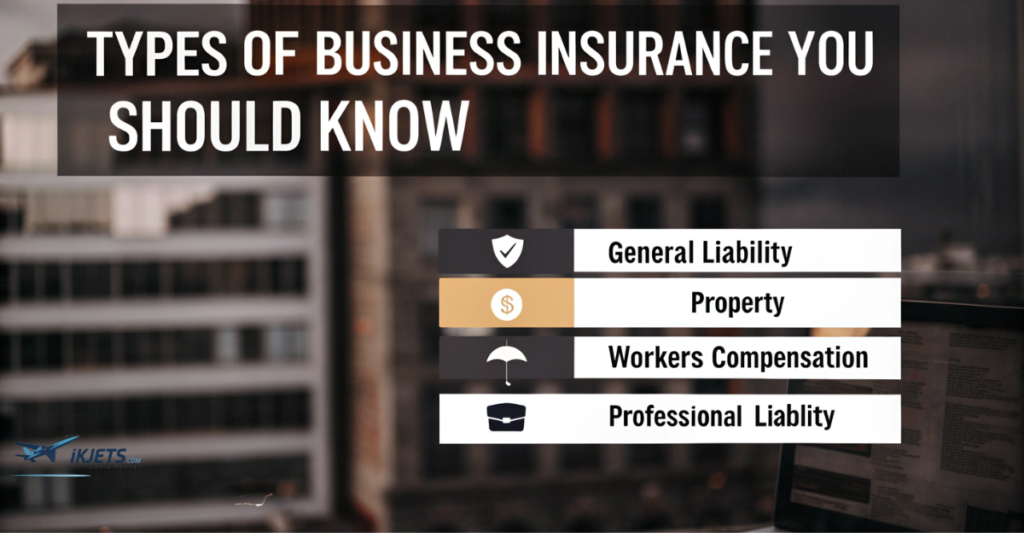

Types of Business Insurance You Should Know

Different risks require different coverage types.

General Liability Insurance

Covers injuries, property damage, and legal claims.

Workers’ Compensation Insurance

Pays medical costs and lost wages for injured employees.

Professional Liability Insurance (E&O)

Protects against client lawsuits for mistakes or negligence.

Commercial Property Insurance

Covers buildings, equipment, and inventory.

Commercial Auto Insurance

Covers business vehicles.

Cyber Insurance

Protects against data breaches and cybercrime.

General Liability Insurance Explained

General liability insurance is the most essential coverage for any business.

It protects you from claims related to:

- Customer injuries

- Property damage

- Product defects

- Advertising injuries

What Does General Liability Insurance Cover?

| Coverage Type | What It Protects Against |

|---|---|

| Bodily Injury | Customer injuries at your location |

| Property Damage | Damage to third-party property |

| Product Liability | Defective product lawsuits |

| Advertising Injury | Libel, slander, copyright claims |

| Legal Defense Costs | Lawyer fees & court expenses |

What General Liability Insurance Does NOT Cover

❌ Employee injuries (covered by workers’ comp)

❌ Professional errors (needs professional liability)

❌ Intentional damage

❌ Contract disputes

Who Needs Business & General Liability Insurance?

Almost every business benefits from commercial insurance, including:

- Freelancers

- Contractors

- Consultants

- Retail stores

- Restaurants

- Online sellers

- IT professionals

Top Professions That Need General Liability Insurance

- Construction contractors

- Real estate agents

- Marketing agencies

- Healthcare clinics

- E-commerce brands

- Cleaning services

How Much Does Business Insurance Cost in 2026?

Average monthly costs:

| Business Type | Avg Monthly Cost |

|---|---|

| Freelancer | $25 – $50 |

| Small Retail Shop | $40 – $90 |

| Contractor | $75 – $150 |

| Tech Startup | $30 – $70 |

Factors That Affect Your Business Insurance Premium

- Industry risk level

- Business size

- Location

- Revenue

- Claims history

- Coverage limits

Four Steps to Buy Business Insurance

1️⃣ Identify risks

2️⃣ Choose coverage

3️⃣ Compare quotes

4️⃣ Purchase & download COI

How to Get Proof of General Liability Insurance (COI)

A certificate of insurance (COI) proves you’re insured.

You may need it for:

- Client contracts

- Leasing offices

- Vendor approvals

Most insurers provide instant COI downloads.

Is General Liability Insurance Required by Law?

It’s not always legally required, but:

- Many landlords demand it

- Clients require proof

- Some states mandate coverage

Business Insurance Providers You Can Trust

- The Hartford

- Chubb

- Hiscox

- NEXT Insurance

- Travelers

External link example:

https://www.thehartford.com/business-insurance

Customer Reviews & Real Success Stories

⭐ “My liability claim was handled in 48 hours. Saved my business!”

⭐ “Instant COI helped me close a big client deal.”

Final Thoughts – Protect Your Business Before It’s Too Late

Running a business without business insurance is like driving without brakes. Accidents happen. Lawsuits happen. Cybercrime is rising.

The smart move in 2026?

Get insured today and protect your income, assets, and peace of mind.

Get Started – Secure Your Business Today

🚀 Get your free business insurance quote in under 60 seconds

📄 Download your certificate of insurance (COI) instantly

💬 Speak with licensed insurance experts

FAQs

Do I need business insurance if I’m self-employed?

Yes. One lawsuit can destroy your finances.

What is the standard general liability limit?

$1M per occurrence / $2M aggregate.

Is CGL the same as general liability?

Yes — CGL = Commercial General Liability.

How fast can I get insured?

Same day in most cases.